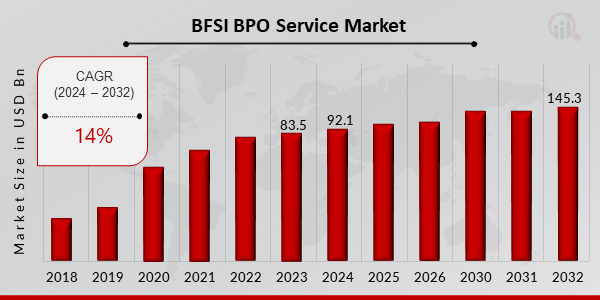

BFSI BPO Service Market is Predicted to Reach USD 145.3 billion at a CAGR of 14% by 2032

BFSI BPO Service Market Growth

BFSI BPO Service Market Research Report By, Service Type, Industry Vertical, Delivery Model, Technology, Company Size, Regional

UT, UNITED STATES, February 20, 2025 /EINPresswire.com/ -- The global Banking, Financial Services, and Insurance (BFSI) Business Process Outsourcing (BPO) Service market has experienced significant growth in recent years and is set for further expansion over the coming decade. In 2023, the market size was valued at USD 83.5 billion and is projected to grow from USD 92.1 billion in 2024 to USD 145.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 14% during the forecast period (2024–2032). The increasing need for cost efficiency, enhanced customer service, and digital transformation in financial institutions are the key factors driving the growth of the BFSI BPO service market.

Key Drivers of Market Growth

Increasing Focus on Cost Efficiency

Banks, financial institutions, and insurance companies are outsourcing non-core business operations to BPO service providers to reduce operational costs and improve efficiency. Outsourcing allows firms to focus on core financial activities while leveraging the expertise of third-party providers for back-office operations.

Growing Adoption of Digital Transformation

The integration of artificial intelligence (AI), robotic process automation (RPA), cloud computing, and blockchain is transforming BFSI BPO services. Financial institutions are increasingly relying on AI-powered chatbots, automated fraud detection, and data analytics to enhance customer service and streamline operations.

Rising Demand for Enhanced Customer Experience

As customer expectations for seamless digital banking, insurance, and financial services grow, BFSI companies are outsourcing customer support and back-office functions to specialized BPO firms. This ensures 24/7 multilingual customer service, improving customer retention and satisfaction.

Stringent Regulatory Compliance and Risk Management

Financial institutions must comply with complex regulatory frameworks across different regions. BFSI BPO service providers offer risk management, regulatory compliance, anti-money laundering (AML), and Know Your Customer (KYC) services, helping businesses stay compliant with evolving global regulations.

Rapid Growth of FinTech and InsurTech Companies

The rise of FinTech and InsurTech startups is driving demand for outsourced services such as loan processing, claims management, and fraud detection. These companies leverage BPO services to scale operations efficiently while maintaining compliance and security.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/29090

Key Companies in the Global BFSI BPO Service Market Include

• Mphasis

• Sutherland Global

• EXL Service

• Accenture

• Cognizant

• SITENEWparaWNS

• HCL Technologies

• Teleperformance

• Genpact

• Wipro

• Tata Consultancy Services

• Capgemini

• Infosys

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/bfsi-bpo-service-market-29090

Market Segmentation

To provide a comprehensive analysis, the global BFSI BPO service market is segmented based on service type, end-user, and region.

1. By Service Type

• Customer Service & Support: Includes call center outsourcing, email support, and chatbot services.

• Back-Office Operations: Covers data entry, document verification, loan processing, and claims management.

• Finance & Accounting Services: Includes payroll processing, tax filing, and financial analysis.

• Risk & Compliance Management: Encompasses fraud detection, regulatory reporting, and AML/KYC services.

• IT & Digital Transformation Services: Involves AI-driven automation, cybersecurity, and cloud-based solutions.

2. By End-User

• Banking Institutions: Retail and commercial banks outsourcing customer service, loan processing, and risk management.

• Insurance Companies: Insurers leveraging BPO for claims processing, policy administration, and fraud detection.

• Financial Services Firms: Investment firms, asset management companies, and payment processors outsourcing data analytics and compliance management.

3. By Region

• North America: Dominates the market due to high BFSI outsourcing adoption and strong regulatory frameworks.

• Europe: Growth driven by increased demand for compliance management and digital banking support.

• Asia-Pacific: Fastest-growing region due to cost-effective outsourcing hubs in India and the Philippines.

• Rest of the World (RoW): Emerging markets in Latin America, the Middle East, and Africa witnessing steady adoption.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=29090

The global BFSI BPO service market is on a strong growth trajectory, fueled by cost-saving benefits, technological advancements, and increasing regulatory complexities. As financial institutions continue to outsource non-core operations to improve efficiency and customer experience, the industry is set to witness transformative changes. With expanding opportunities across various regions and BFSI segments, the future of the BFSI BPO service market looks highly promising.

Related Report –

Refinancing Market

Livestock Insurance Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release