Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 24.4% compared to 20.4%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

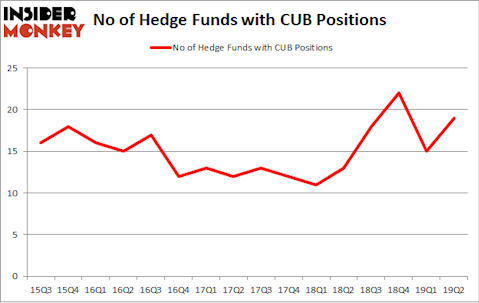

Is Cubic Corporation (NYSE:CUB) a safe investment today? The best stock pickers are becoming hopeful. The number of long hedge fund positions went up by 4 in recent months. Our calculations also showed that CUB isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the key hedge fund action regarding Cubic Corporation (NYSE:CUB).

What does smart money think about Cubic Corporation (NYSE:CUB)?

Heading into the third quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from the first quarter of 2019. On the other hand, there were a total of 13 hedge funds with a bullish position in CUB a year ago. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, SG Capital Management, managed by Ken Grossman and Glen Schneider, holds the biggest position in Cubic Corporation (NYSE:CUB). SG Capital Management has a $19.2 million position in the stock, comprising 3% of its 13F portfolio. The second most bullish fund manager is Peter Schliemann of Rutabaga Capital Management, with a $11.2 million position; 3.2% of its 13F portfolio is allocated to the stock. Remaining peers that hold long positions include Ken Griffin’s Citadel Investment Group, Sander Gerber’s Hudson Bay Capital Management and Chuck Royce’s Royce & Associates.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Hudson Bay Capital Management, managed by Sander Gerber, established the most outsized position in Cubic Corporation (NYSE:CUB). Hudson Bay Capital Management had $4.6 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $0.9 million investment in the stock during the quarter. The other funds with brand new CUB positions are John Overdeck and David Siegel’s Two Sigma Advisors, Noam Gottesman’s GLG Partners, and Michael Gelband’s ExodusPoint Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Cubic Corporation (NYSE:CUB) but similarly valued. These stocks are Conduent Incorporated (NYSE:CNDT), Meritage Homes Corporation (NYSE:MTH), Inter Parfums, Inc. (NASDAQ:IPAR), and Great Western Bancorp Inc (NYSE:GWB). All of these stocks’ market caps are similar to CUB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNDT | 27 | 591464 | -3 |

| MTH | 15 | 191125 | 1 |

| IPAR | 17 | 92111 | -5 |

| GWB | 9 | 42177 | -5 |

| Average | 17 | 229219 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $229 million. That figure was $55 million in CUB’s case. Conduent Incorporated (NYSE:CNDT) is the most popular stock in this table. On the other hand Great Western Bancorp Inc (NYSE:GWB) is the least popular one with only 9 bullish hedge fund positions. Cubic Corporation (NYSE:CUB) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CUB as the stock returned 9.4% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.