Has Trump And The US Inked A Silent ‘Trade Win’ Against China For Now With Its Rough Tariff Ball Game?

And while Trump pushes AI giants like Nvidia to toe the geopolitical line, and Apple bankrolls a homegrown rare earth revival with Pentagon backing, one fact remains: the trade deficit hasn’t budged, it’s just wearing a different flag.

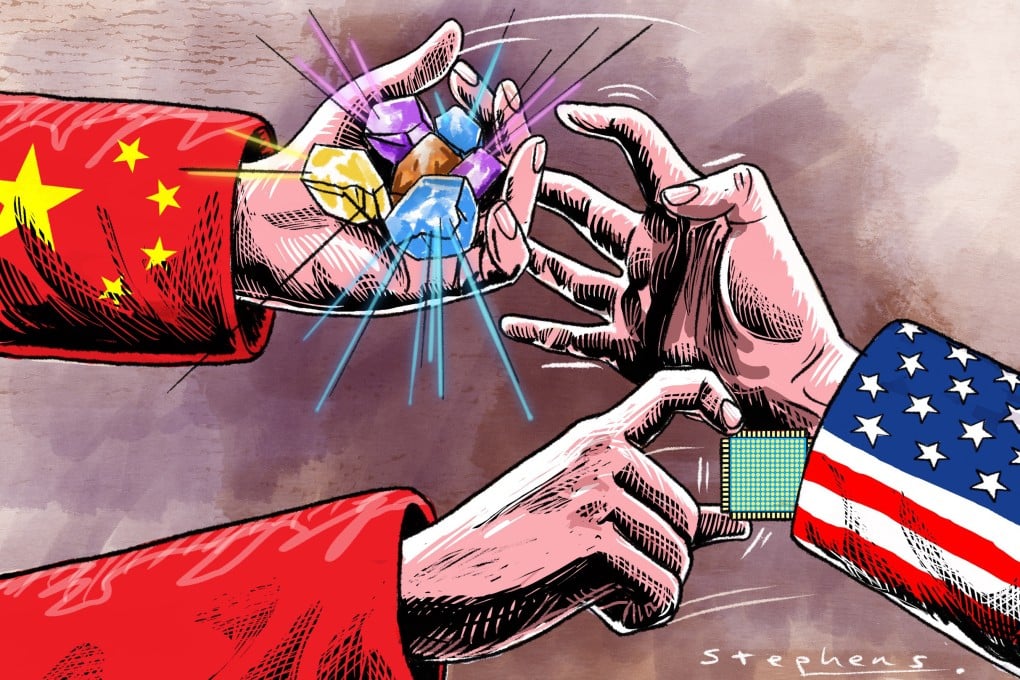

The oldest currency of conflict: trade has resulted in a rough ride between Washington and Beijing, with both superpowers locking horns not just over Taiwan or AI supremacy. The tug-of-war has grown sharper, bolder, and more strategic under President Trump’s second innings in the Oval Office.

In April, Trump stunned markets by announcing a blistering 145% tariff on a broad spectrum of Chinese imports. Predictably, China retaliated. But just as fears of an all-out trade war reignited global anxiety, the two giants pulled back, just a little. In May, high-level negotiations led to a temporary détente: U.S. tariffs were lowered to 30% for a 90-day window, while China cut its own duties from 125% to 10%.

A breather, yes; but a ceasefire, hardly.

Trade remains just one area in a much broader competition, where influence, dominance, and economic survival are all in play. And behind the usual soundbites and tough talk, something more subtle seems to be unfolding.

If the standoff escalates once again, analysts expect China to reroute its overcapacity toward Europe, using EU markets as a pressure valve. But here’s the twist: the U.S. might counter by redefining country-of-origin rules, treating Chinese goods manufactured in Europe via Chinese investment as de facto Chinese exports and slapping them with tariffs too.

At the same time, while the U.S. is tightening the noose around some Latin American economies, Beijing is quietly deepening its roots across South America, locking in long-term infrastructure, mining, and tech alliances.

So amid all this, has Trump quietly notched a win?

The Rare Earths, A Magnet for Strategic Advantage

Let us shine the spotlight where few are looking but where Trump seems most fixated: rare earth metals – those unsung elements essential to AI, EVs, smartphones, and missile guidance systems.

Trump’s rare earths obsession isn’t new. Greenland, Canada, even domestic sites have all been floated in past years. But now, the U.S. is not just talking about supply chains, it’s buying into them, literally.

And at the center of this evolving play is Nvidia, now the world’s most valuable company, having just added $145 billion to its market cap in a single trading session. Valued at nearly $4.15 trillion, Nvidia now towers over Microsoft, Apple, and Amazon.

But beyond its valuation lies a more fascinating development: Nvidia’s H20 AI chips, once blocked from being sold to China, are now part of a trade negotiation package involving, of all things, rare earths.

From Chips to Magnets- A Backdoor Bargain?

In an eyebrow-raising admission, U.S. Commerce Secretary Howard Lutnick confirmed this week that Nvidia’s planned resumption of H20 chip sales to China was bundled into a trade deal involving rare earth magnets.

“We put that in the trade deal with the magnets,” Lutnick told Reuters, hinting at a rare diplomatic fusion of geopolitics, AI dominance, and material science.

In plain terms: the U.S. gets critical rare earth supply for its manufacturing base, and in return, Nvidia can legally sell slightly downgraded AI chips to China, chips that still run on Nvidia’s globally dominant software.

This deal comes just after Nvidia CEO Jensen Huang met with Trump, suggesting some high-bets wheeling and dealing behind closed doors.

Of course, not everyone is pleased. Critics across the aisle are calling the move hypocritical and dangerous.

“The decision would not only hand our foreign adversaries our most advanced technologies but is also dangerously inconsistent,” said Democratic Representative Raja Krishnamoorthi.

Republican counterpart John Moolenaar echoed the concern, citing how China’s DeepSeek AI startup has already surged using prior-generation chips.

China May Be a Rival But It’s Still the Revenue Engine

Nvidia might be the crown jewel of AI innovation, but even with all its silicon swagger, there’s one hard truth it can’t algorithmically ignore: China is just too big to exit.

“The Chinese market is massive, dynamic, and highly innovative,” said CEO Jensen Huang on Chinese state TV, during a visit that’s being watched like a geopolitical thriller on both sides of the Pacific. Not surprising, considering China delivered $17 billion in revenue to Nvidia’s books last fiscal year, accounting 13% of its global sales.

So, it’s hardly shocking that Chinese tech titans like ByteDance and Tencent are already queueing up to grab Nvidia’s “legally exportable” H20 chips. Nvidia, playing by Washington’s rulebook, has reportedly created a compliance-approved buyer list to keep the sales process clean but don’t be fooled, the bets are still sky-high.

Predictably, China isn’t taking this lying down. When questioned about Nvidia’s rebooted chip sales plan, Beijing hit back with a familiar rhetorical swing: “China is opposed to the politicisation, instrumentalisation and weaponisation of science, technology and economic and trade issues…”

The irony, of course, writes itself. China had already weaponised trade in March when it cut off rare earth exports, a move that spooked Washington and offered President Trump just the opening he needed.

Apple Isn’t Waiting Around, It’s Magnetizing Its Future at Home

While Nvidia walks a tightrope, Apple is opting for a clean break or at least a domestic hedge. In a move that didn’t make banner headlines but might reshape its future, Apple signed a $500 million deal with MP Materials, a U.S.-based rare earth supplier now partially owned by the Pentagon.

The agreement secures Apple a consistent stream of rare earth magnets, critical components for devices like iPhones, AirPods, and even EV produced entirely on U.S. soil. No China. No customs drama. And perhaps most critically, no sudden geopolitical blackouts.

MP’s plan – use recycled materials from its Mountain Pass, California, facility and manufacture the magnets in Fort Worth, Texas. Apple’s move – front $200 million now to buy long-term insurance against future global volatility. If Tim Cook’s thinking is: “No magnets, no motion,” he’s probably not wrong.

“We’re in an era where executives are willing to pay a significant premium for a reliable supply chain,” said Gracelin Baskaran of CSIS. “They don’t want stoppage.”

MP stock soared 21% on the news, and with the Pentagon preparing to become its largest shareholder, this is more than just a corporate handshake, it’s a strategic alliance.

Realignment Isn’t Just Political, It’s Industrial

Apple’s magnet move slots neatly into a broader American strategy: de-risking from China without decoupling entirely. The U.S. is now talking price floors for rare earths, subsidies for domestic mining, and supply chain rewiring not because it’s fashionable, but because it’s necessary.

This is about more than iPhones and GPUs. It’s about controlling the raw materials that power everything from smartphones to fighter jets. And competitors like AMD have gotten the memo, filing their own licence applications to resume AI chip sales to China, despite the potential backlash.

Everyone wants to stay in the China game. But on their own terms.

China’s Numbers Look Solid But the Cracks Are Spreading

And while Beijing has managed to post a respectable 5.2% GDP growth in Q2, not all that glitters is growth. The figure narrowly missed the previous quarter’s 5.4%, but still keeps China on track for its “around 5%” annual target. Thanks in part to a brief de-escalation in tariff warfare that let Chinese exporters front-load shipments before the July tariff wave.

“The Q2 number was propped up by state stimulus and a strategic export push,” said Zhiwei Zhang of Pinpoint Asset Management.

But beneath the surface, cracks are showing. Consumer confidence remains shaky. Prices are sliding. And the property sector, China’s economic backbone, is in a full-blown identity crisis.

“The real estate crisis is a major drag on local government budgets,” warned Dan Wang of the Eurasia Group.

Markets are already bracing for a slower second half, with more state stimulus expected in the upcoming July Politburo meeting. Still, the long-term sustainability of this growth is anyone’s guess.

And in the broader scheme of things, China’s dominance is far from fading. According to the Prognos Institute, Chinese companies now make up 16% of global exports, twice that of Germany. The trade chessboard isn’t shrinking. It’s just getting more complex.

U.S.–China Trade Falls Off a Cliff. A Trump Tariff Triumph or Just Clever Redirection?

Now here is where it gets tough – China now accounts for just 5.89% of total U.S. trade as of May, its lowest monthly share in over 23 years, according to fresh U.S. Census Bureau data. That’s a stunning fall from its heyday of 17.77% when Donald Trump first entered the White House. The big question is: Did tariffs actually work? Or did the trade just quietly rebrand and reroute?

The story goes back to 2017, when Trump launched what would become the most aggressive tariff campaign in modern U.S. history. President Biden inherited and maintained those tariffs. Now in his second term, Trump is doubling down and, by the numbers, China’s presence in U.S. trade has been absolutely pummeled.

But here’s the kicker: while the U.S. trade deficit with China has plunged 29%, the total deficit hasn’t shrunk, it’s just found new dance partners. Mexico, Canada, South Korea, Taiwan, and Vietnam are picking up the slack and then some.

Let’s put that in perspective:

Deficit with Mexico: Up 121%

Canada: Up 241%

South Korea: Up 268%

Taiwan: Up 385%

Vietnam: Up 213%

So, sure, less China. But more everyone else. And in many cases, China’s goods are simply finding new entry points into the U.S. via friendlier ports, with some crafty “rules of origin” labeling tricks along the way. Vietnam, for example, has become a sudden star in the U.S. import picture. Coincidence, not quite.

In response, Trump’s so-called “Liberation Day” tariffs, initially announced in April, paused, and now extended through August 1, are targeting these very countries. The suspicion is that they’re serving as backdoors for Chinese goods.

A Decoupling That’s Real But at What Cost?

Let’s not ignore the headline – U.S.–China trade has fundamentally decoupled. In 2017, China was the No. 1 trade partner of the U.S. by a comfortable margin. In 2025 – it’s barely holding third place, trailing far behind Mexico (16.22%) and Canada (12.53%).

It’s not just rankings. China’s share of U.S. imports has collapsed from over 20% pre-2018 to just 7.41% in May. And in some categories, the drop is even more brutal. Last year, China owned 44.7% of all U.S. cellphone imports. In May, it ranked fourth, behind India, Vietnam, and Thailand.

Compare 2025 to 2018:

U.S. imports from China: Down 27.6%

U.S. imports from the world: Up 47.3%

The shift in U.S. exports tells a similar story:

Exports to China: Down 12.5%

Exports to the world: Up 30.2%

And the hit list is long:

$3 billion less in U.S. oil exports to China

$2.5 billion decline in car exports

Nearly $700 million drop in motor vehicle parts

On the import side:

$12.9 billion fewer cellphones

$10.6 billion fewer computers

Declines across TVs, furniture, and electronic components

So yes, if the goal was to shrink China’s footprint in U.S. trade, mission accomplished. Six of the ten highest China trade months in two decades occurred during Trump’s first term. Fast forward to 2025, and three of the four lowest months ever recorded are under his second.

But here’s the irony: while China’s star has dimmed, the overall U.S. trade deficit hasn’t improved -it’s ballooned. Whether it was under Trump 1.0, Biden, or now Trump 2.0, the deficit keeps growing, topping $1 trillion in four of the last five years. Meanwhile, relations with allies are under strain—collateral damage from a tariff war that has gone global.

The Last Bit